|

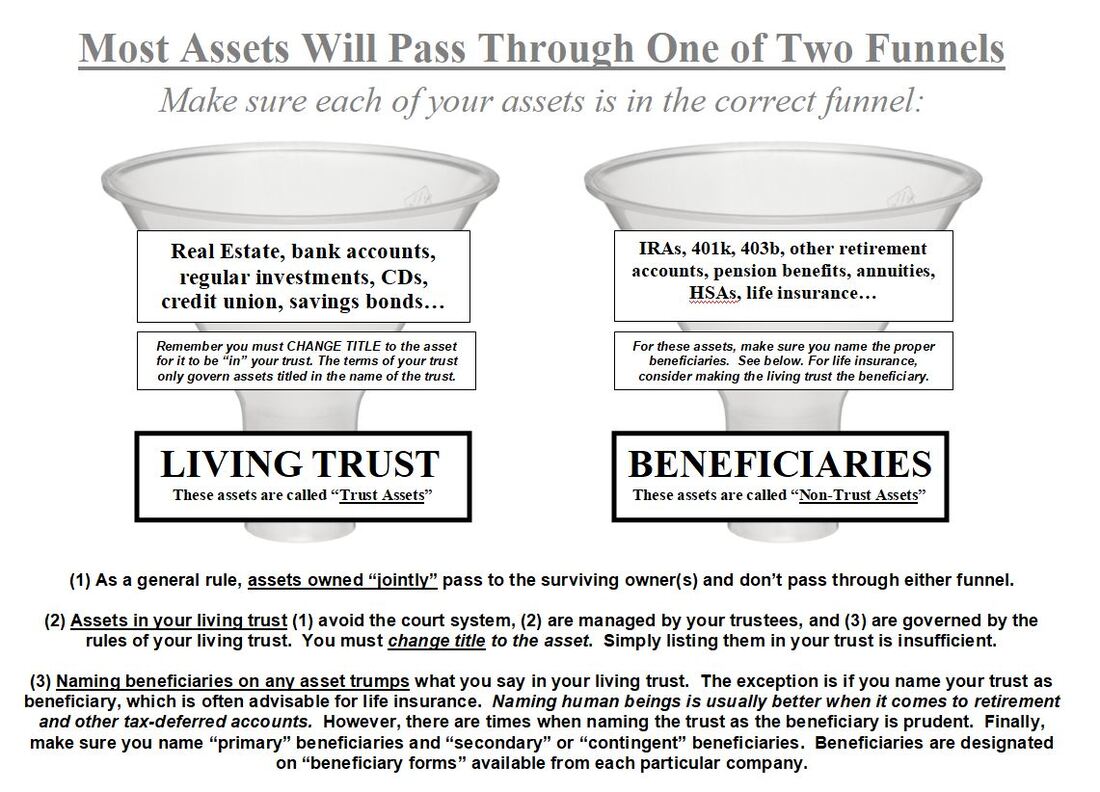

A few years ago, I created the above graphic to help illustrate to clients how their assets will pass once they create a living trust. Basically, I explain that every asset they have will pass through one of the two funnels. Like animals at the zoo, we don't put all of the animals in the same cage.

Some clients make the mistake of believing that all of their assets are controlled by their living trust (simply because they created a living trust). A living trust has no magical properties that control your assets. A living trust only controls assets that are actually titled in the name of the living trust. That being said, not every asset you have will be in the name of the living trust...only certain assets. If you take a look at the above graphic, you will notice that real estate, bank accounts, regular investment accounts, certificates of deposit, credit union accounts, and savings bonds need to be titled in the name of the living trust. There may be other assets as well but these are the big ones. What does it mean to "title" the asset in the name of your trust. That means your asset will no longer simply have your name on it. For example, your bank account or real estate won't simply say "John Smith" on it. It will say "John Smith Living Trust" instead. You will also notice the graphic indicates you must change title to the assets for them to be considered "in your trust." However, the graphic also indicates that certain assets will pass through the "beneficiary" funnel. These are basically retirement type accounts and life insurance policies. This would include individual retirement accounts (IRAs), 401k, 403b, other retirement accounts, pension benefits, annuities, health savings accounts, and life insurance. These type of assets are driven by a contractual relationship with the financial institution. When you open these accounts, you will fill out something called a "beneficiary form" which dictates who gets the account upon your passing. Notice they don't care what your living trust says or whether you even have one! All they care about is who is indicated on the beneficiary form. For these assets, you have to make sure you fill out the proper forms and indicate both primary and secondary beneficiaries. In some cases, you can name your trust as a beneficiary but you should not do so automatically. You should consider the pros and cons. Like any estate plan, there is often no perfect answer - only the best answer given all the circumstances. As a general rule, assets owned "jointly" do not pass through either funnel. Assets owned jointly pass to the surviving owner. Therefore, If Bob and Sally own a bank account together and are listed as joint owners, Sally gets the entire account when Bob passes away. It doesn't matter what the living trust says. This can be especially problematic when people have second marriages. If they put the new spouse on an account or a parcel of real estate, that new spouse gets the entire asset. For example, let's say Bob and Sally are married. When Sally passes away, Bob gets remarried a few years later to Mary. Bob puts Mary as a joint owner on his assets. When Bob dies, Mary gets everything - end of story! It doesn't matter what Bob's living trust says. Joint ownership trumps. There are three general benefits to having your assets titled in the name of your living trust. First, anything in the name of your trust avoids the court system. Second, anything in the name of your trust is managed by your named successor trustees in the order you list them. Finally, any assets in the name of your trust are governed by the rules of your trust. Again you have to change title to the asset. You can't just think about it or list of the asset somewhere in the trust or on a schedule somewhere. That's not the same thing. Again, once you create your living trust, you should understand that your assets will pass through two separate funnels depending on the nature of the asset. It's one thing to have a living trust - it's another thing to understand how it works. Hopefully this will assist you in understanding proper trust funding and proper beneficiary designations. If you need help with your estate plan, please call (661) 414-7100 to see if we can assist you. Comments are closed.

|

By Attorney Robert MansourRobert Mansour is an attorney who has been practicing law in California since 1993. Click here to learn more about Robert Mansour. |

Call 661-414-7100 / Text 661-249-9990

RSS Feed

RSS Feed