|

VIDEO TRANSCRIPT:

Hi everybody, this is Rob Mansour, and I'm making a brief video today about the probate process in California. So sometimes we have clients and they call and they say, "Hey, I need your help with a probate matter" or "Can you help me or guide me with a probate question?" So really the first threshold question is whether or not a probate is necessary at all. So if some clients have a living trust, for example, and all of their assets are in the name of the trust, so for example, their house is owned by the Smith Family Trust, their bank accounts say Smith Family Trust, all of that would not need probate. So we don't really need to go to the probate court for that. Sometimes people are told by banks and other institutions that they need to go to probate, but upon closer inspection, we find out they don't really need to go to probate court at all. So what we generally do is we have to do an analysis. So the first thing that we do is we gather all of the client's assets or we make a list of them. So all of these business cards, for example, represent all of the client's assets. Let's say Mr. Smith passed away, I get a call from Mr. Smith's children and they say, "Hey, do we need to go to probate court at all?" So generally this is how it works. We take one asset at a time and we ask ourselves the following question, "Was this asset in the name of a trust?" If the answer is no, then "Was the asset held jointly?" For example, was Mr. Smith on the account along with one of his children if that was the case, or perhaps his wife? If that is the case, then the other person on the account gets all the money. So let's say Mr. Smith has a bank account with $100,000 in it and his son Johnny is on the account with him. Well, Johnny gets all that money. That's a joint account. Now whether Johnny wants to take that money and go to Vegas or whether Johnny wants to share that money with his siblings is a whole other discussion. And then we go through each asset and we ask ourselves the same questions, "Was it in the name of a trust?" "Was it jointly owned?" If it wasn't jointly owned, then perhaps the individual had a beneficiary on the account. So for example, when they opened the account, it's just in Mr. Smith's name, but maybe he named his daughter Jenny as the beneficiary of that account. If that is the case, then that money goes to Jenny, whether she chooses to go to Vegas or not with that money, that's her decision. She can go and buy a new car with that money, she can do whatever she wants. That's her money. Again, whether she chooses to share with her siblings is a whole other discussion. So then that leaves us with a handful of other assets. Now, if these assets were only in Mr. Smith's name, such as a house or a bank account, etc, and if the total value of those things exceeds $184,500, which is the current limit in California, that's the current threshold. Now, that number used to be lower than that, and it changes every few years so you need to make sure that you check and make sure that that is the correct number. But anyway, if the aggregate amount exceeds that threshold number, then you might have to go through the probate court process after all. So basically, not all the assets may need to go through probate. Some of them might and some of them might not. So let's assume for the sake of discussion that some of the assets have to go through the probate process. So here's how it works. You hire a lawyer generally to help you with this process, although some people are very, can-do kind of people, and maybe they do this on their own, but let's say you hired a lawyer and you did things the traditional route. The first step would be the attorney has to petition the court to open the probate. Basically, they have to file some paperwork with the court asking the judge to open a probate for this particular estate. And to do that, they need somebody called an "executor." So the executor is basically the person in charge of the probate. So usually it's one of the kids. It could be a friend or a family member, and usually the executor would be listed on the will. That's where you find the executor. Now, if there was no will and there is no executor, then generally somebody has to volunteer to do that job. And in the California probate code, there is a hierarchy of people who are allowed to do that job. But generally speaking, as long as there's no major objection, somebody can step forward and become the point person for the probate and they become the executor or administrator of the estate. Now, with these initial filings, you have to pay a filing fee, which is about $500. And then what happens is the court will open the probate and at the initial hearing, generally they will approve the executor. And in some cases the judge might give the executor great latitude to do whatever they want during the probate process, such as sell the property, do this or that. There is a valuation of the estate during this period of time, and the court will have somebody at the court who is in charge of evaluating the estate. Usually this person is called a probate referee. And then you might have your own opinion about the evaluation of the estate. Either way, the estate will be valued at some point, and then what happens is the judge is going to give "permission slip" to the executor to do what they need to do. And that permission slip is generally called "letters testamentary." So "letters testamentary" is something you might hear from when you go to the banks and stuff like that. They might say, "We need letters testamentary from you." Or you might get letters that say "we need letters testamentary." All that really means is it's a permission slip from the judge. So Bob or whoever the executor is can go and do what he needs to do. And basically armed with that permission slip, if you will, the judge, they can go do all of these things including sell the real estate if necessary. Now, there's also a period of time that creditors need to be notified about the probate process, and they have a certain period of time within which they need to file a claim - a "creditor's claim" with the court where they say, "Hey, we're owed $10,000 from Mr. Smith's estate," or "We're owed $50,000." And basically if they don't assert a creditor's claim during that period of time, they might be out of luck and they can't come back later and say, "Hey, we need, we want our money." Well, it's too late now. You had your chance, you had a period of time within which to file your claim, but you didn't do it. So now you're out of luck. And then basically what happens is once everything has been administered, once the property has been sold, all the assets have been collected, then what happens is a petition will be filed with the court asking the court to close out the probate, to finish the probate. Then what happens is the judge will issue an order. And this is the order where the judge says, "Hey, this is what the lawyer's fees are going to be. This is what the executor is going to get paid." And it's all based on the value of the estate. By the way. Typically it's 4% of the first a hundred thousand, 3% of the second, a hundred thousand 2% of the next 800,000, etc. And you can find probate calculators online where you enter the amount of the estate going through the process, and that will give you an estimate as to what the lawyer's fees are going to be. And if the executor wants to assert a fee, typically the executor gets paid the same as the attorney. And then after all of that is done, the court will then order the distribution of the estate, and the executor needs to see to it that everything is distributed. There might be some additional paperwork filed with the court at the very, very end of the process. Now, the probate process can take as little as maybe nine months to two years depending on the complexity of the case, depending how backed up the court the courthouse is and how many cases the judge is handling at the time. But as a general rule, you want to avoid the probate process. And one of the best ways to do that is to create a living trust and that living trust will own all of the assets instead of the individual. The nice thing about a living trust - - so say that this cup right here is the living trust and all of the assets are inside the living trust and owned by that living trust. The living trust doesn't die. It doesn't get cancer, it doesn't get Alzheimer's disease. It because it doesn't get dementia, it doesn't get pancreatic cancer. It just keeps on going. And after the individual dies, there's no need to go see the judge because this thing owns all the assets and a new "CEO" steps in to manage this trust. That "CEO" is called the "successor trustee." If you have to go through the probate process, the best thing to do is to contact an attorney and work through the process with that lawyer. Let the lawyer take a fee. It's better than you doing all that work. Whether or not you choose to take a fee or not is up to you. Hopefully the process doesn't take as long as you might fear. In any event, the judge wants to make sure that the right people get the assets, and that's why it is a court supervised process. But you can avoid all of that if you create a living trust. But that's another video for another time. My name is Robert Mansour, and hopefully you found this video helpful. If you need help or guidance with your probate matter, please feel to contact our office. Take care. bye-bye. A crucial part of financial management is estate planning which can help make sure that your assets are distributed pursuant to your wishes. Beneficiary designations on bank accounts, life insurance policies, and retirement accounts are commonly used. Using beneficiary designation is easy and often effective. We will discuss the pros and cons of beneficiary designations in this post.

The Advantages of Designated Beneficiaries Ease and Quickness Beneficiary designations provide an easy way to distribute your assets. You want "Johnny" to get your IRA? All you have to do is fill out a form. You can specify who will get the proceeds from your bank accounts, life insurance policies, and retirement accounts by just completing out a form. Steer clear of Probate Using beneficiary designations has several important benefits, one of which is that the assets avoid going through the probate procedure. The procedure of probate can be drawn out and expensive, which could cause a delay in the beneficiaries receiving your assets. Beneficiary designations allow assets to be transferred directly to designated beneficiaries, bypassing the probate court. Confidentiality and Privacy Asset transfers made through beneficiary designations stay private because they avoid the probate process. Since probate is a public procedure, information about your estate will be available to the public. Beneficiary designations, on the other hand, enable a more covert transfer of assets. Flexibility Beneficiary designations are quite flexible and simple to change. You can modify your beneficiary designations to match your current intentions if your circumstances change, such as when you get married, divorce, or have a kid. This adaptability guarantees that your resources are consistently in line with your goals. In some cases, all you have to do is fill out a new beneficiary form online. The Potential Drawbacks of Designating Beneficiaries Outdated Beneficiary Forms The fact that beneficiary designations might go out of date is one of the most frequent problems with them. Major life events like divorce or the birth of a new child could cause you to neglect to change your designations, which could result in the distribution of your assets against your current preferences. It's crucial to verify and update your beneficiary designations on a regular basis. Your Will or Trust Might Be Different The designations made by beneficiaries supersede your will or living trust. Some folks think their trust or will govern the distribution of everything. That is a common misunderstanding. Who you have as designated beneficiaries may not line up with your will or trust. They don't have to but it's good to double check if your wishes are truly reflected in those designations. Beneficiary designations may cause disagreements among heirs if they are unclear or conflict with other estate planning instruments. For your loved ones, this might mean delays and further stress during an already trying time. Absence of Emergency Planning Many forget to designate contingent beneficiaries, or those who will inherit the assets in the event that the principal beneficiary passes away before them. One of the primary purposes of beneficiary designations is to avoid probate proceedings for the assets in the event that there are no contingent beneficiaries. We have found in our practice that clients either have the wrong beneficiaries, incomplete beneficiaries, or none at all when they check to see what they actually have. Handling Particular Situations When handling unique conditions like blended families, minor children, disabled beneficiaries, elder beneficiaries, complicated financial situations, or charitable purposes, living trusts are especially helpful. They provide a degree of adaptability and personalization that is unmatched by straightforward beneficiary designations. In summary Beneficiary designations are an effective estate planning technique that can avoid probate and give efficiency and simplicity. They do have some possible drawbacks, though, like out-of-date designations, issues with your will, and a lack of backup plans. You should think about designating a trust as the beneficiary of your bank accounts, life insurance policies, and retirement accounts in order to reduce these risks and obtain extra advantages. Trusts can handle intricate estate planning requirements and offer improved control, protection, and tax benefits. You and your loved ones can have peace of mind knowing that your assets are dispersed in accordance with your preferences by making thoughtful plans and routinely reviewing your beneficiary designations. Make sure to discuss the pros and cons when speaking with your attorney about your estate plan. High net worth individuals and couples should be concerned about several key aspects of federal estate planning and tax planning to minimize their estate tax liability and ensure the effective transfer of wealth to future generations. Some considerations include:

Creating an estate plan can help ensure that your assets are managed and distributed according to your wishes after you pass away. However, it can also help you during your lifetime. Here are some of the top reasons to create an estate plan:

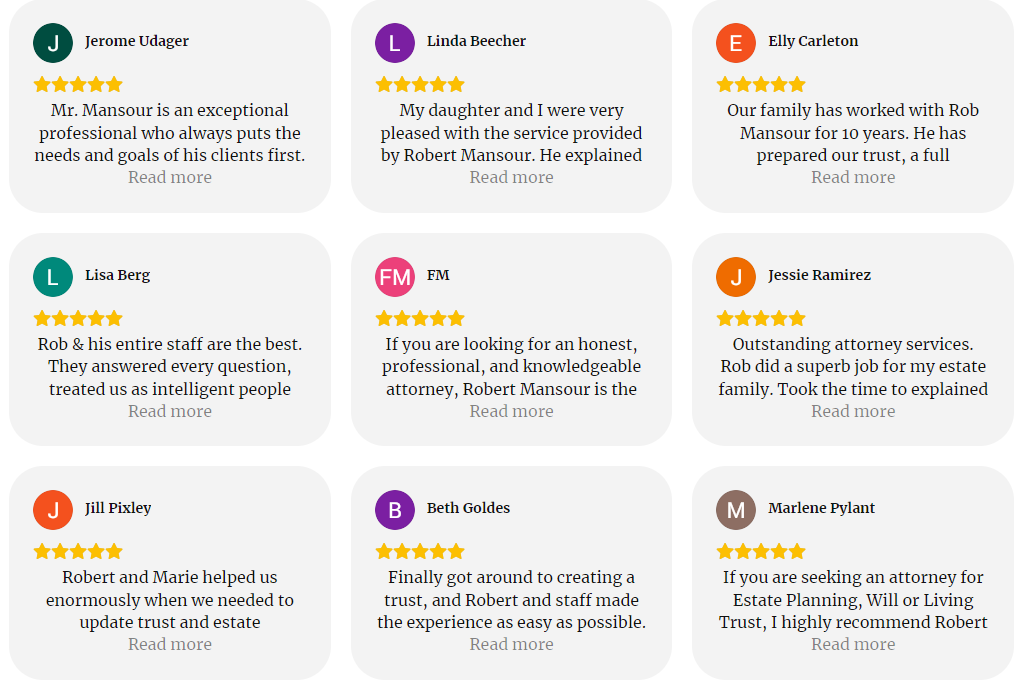

It's always nice to receive great reviews from our clients. Here is a nice certificate we just got from Yelp, recognizing our office as "beloved business" on Yelp in 2023. We are looking forward to a great 2024 as well. If we can be of assistance, please give us a call and we'll do our best to help you!

In California, as in many other jurisdictions, joint tenancy and tenancy in common are two different forms of property ownership, each with its own characteristics and implications. Here's a breakdown of the key differences between joint tenancy and tenancy in common in California:

In California, a will and a living trust are two different estate planning tools that serve similar purposes but have distinct characteristics. Here are the main differences between a will and a living trust:

However, it's important to note that estate planning is a complex process, and the suitability of a will or a living trust depends on individual circumstances. It's best to consult with an experienced estate planning attorney in California to determine the most appropriate approach for your specific needs and goals. What if you forget to re-title all your assets into the name of your living trust? Will your heirs necessarily be going through the probate process? Well, thanks to a 1993, your family might be able to back-door any such forgotten assets into your trust by using the Heggstad Petition.

The Heggstad Petition refers to a legal process in California that allows for the transfer of assets into a living trust after the trust creator's death, even if those assets were not initially included in the trust. The petition takes its name from the California appellate case, In re Estate of Heggstad, which established the legal precedent for this type of petition. The Heggstad case, decided in 1993, involved the estate of a man named Gunnar Heggstad who had created a living trust but failed to transfer a specific piece of real estate into the trust before his death. The court ruled that the property should be included in the trust based on the decedent's intent and the surrounding circumstances, even though the formal transfer had not occurred. Following the Heggstad decision, California Probate Code Section 850 was amended to provide a procedure for filing a Heggstad Petition. This petition allows a trustee or interested party to ask the court to confirm the inclusion of assets that were not properly transferred to the trust but were intended to be included. To have a successful Heggstad Petition in California, the following components are typically required:

Probate is the court process of settling someone's estate after the death of that person. It's not always necessary. Just because someone died and they had a few assets doesn't automatically mean their estate will need to go through the probate process. The first step is to inventory all assets. If there is a joint owner on an asset, it goes to the surviving owner. If there is a beneficiary on an asset, it goes to that beneficiary. If the asset is in the name of a trust, the trust will govern the distribution of that asset. Generally, probate is only necessary for assets in the decedent's name alone that do not pass by any other means. Also, in California there is a threshold amount of such assets before you even have to bother going to court. In other words, don't assume probate is automatically necessary.

In California, the probate process can be frustrating, complicated, and time-consuming. It's important to understand the steps involved and the costs and fees associated with the process. Step 1: Filing the Petition for Probate The first step in the California probate process is to file a petition for probate in the court in the county where the deceased person lived. The petition must be filed by the executor named in the deceased person's will or by an interested party if there is no will. The California probate Code outlines a list of individuals who may petition the court for probate (assuming no one has been nominated in a will). In short, a "petition" is a request of the court to appoint someone as the executor of the estate - someone who will be in charge of distributing the decedent's assets. The petition must include information about the deceased person's assets, liabilities, debts, and beneficiaries. The probate filing fee varies by county but typically ranges about $500. Step 2: Appointment of Executor or Administrator Once the petition is filed, the court will schedule a hearing date to appoint an executor or administrator for the estate. The executor is usually named by the decedent in the will, but if there is no will, the court will appoint an administrator. The executor or administrator is responsible for managing the decedent's assets, paying debts and taxes, and distributing the remaining assets to the beneficiaries. The executor or administrator must often post a bond, which is a type of insurance policy that ensures the estate will be properly managed. The cost of the bond varies depending on the size of the estate but can range from a few hundred to several thousand dollars. In some cases, the court might waive the bond. Usually the court will insist on a bond even if it's waived in the will. Step 3: Inventory and Appraisal of Assets After the executor or administrator is appointed by the court, they must prepare an inventory and appraisal of the decedent's assets. This includes identifying all of the assets, such as bank accounts, real property, and personal property, and determining the value of said property. The cost of the appraisal varies depending on the complexity of the estate but can range from a few hundred to several thousand dollars. Step 4: Payment of Debts and Taxes The executor or administrator must pay all of the debts and taxes before distributing any assets to the beneficiaries. This includes filing tax returns for the decedent and in some cases for the estate. In some cases estate taxes that may be owed. The cost of paying debts and taxes varies depending on the amount owed and the complexity of the estate. Step 5: Distribution of Assets Once the debts and taxes have been paid, the executor (or administrator) can distribute the remaining assets to the beneficiaries (pursuant to a final court order). This includes transferring ownership of real estate, personal property, and distributing any remaining cash or investments. The executor or administrator must file a final accounting with the court, which details all of the income, expenses, and distributions made from the estate. The court issues a final court order closing out the probate and instructing the executor what to do. Probate costs and fees varies depending on the size and complexity of the estate. Some costs and fees that may be associated with the probate process include:

Overall, the cost of probate in California can range from a few thousand dollars to tens of thousands of dollars, depending on the size and complexity of the estate. It's important to consult with an experienced estate planning attorney to understand the probate process and the costs and fees involved. If you plan your estate properly, you can avoid probate altogether. Probate is a public process, takes a long time, and can be quite frustrating to all those involved. |

By Attorney Robert MansourRobert Mansour is an attorney who has been practicing law in California since 1993. Click here to learn more about Robert Mansour. |

Call 661-414-7100 / Text 661-249-9990

RSS Feed

RSS Feed